The second reason why many airports don’t leverage one of their most valuable assets—land—is because they lack a strategic vision for their future aeronautical needs. Successful airports have mapped out the concrete next steps that are needed to grow. They’ve outlined different scenarios for future runway and terminal expansions, and identified parcels of land that will remain unaffected by those plans. That process enables them to pinpoint sites for non-aeronautical development—and to reap enormous rewards. Leading global hubs like Amsterdam Schiphol, for example, generate up to 20% of their overall income—and more than a third of their profits—through landside real estate. That’s because the profit margins on commercial developments are considerably higher compared to aeronautical charges.

Less successful airports, on the other hand, lack that kind of strategic vision. Unclear on the next steps, they hold all their land in reserve just in case some of it might be needed for future expansion projects. In so doing, they forego a massive amount of income that could be gained through landside real estate.

How can airports overcome these two obstacles? The first step is to identify parts of the airport area that are unlikely to be needed for future expansion projects. Are you really going to build a new runway at the entrance to the airport, or on land that’s right next to a heavily populated residential area? Probably not. On the other hand, these are prime locations for future commercial developments.

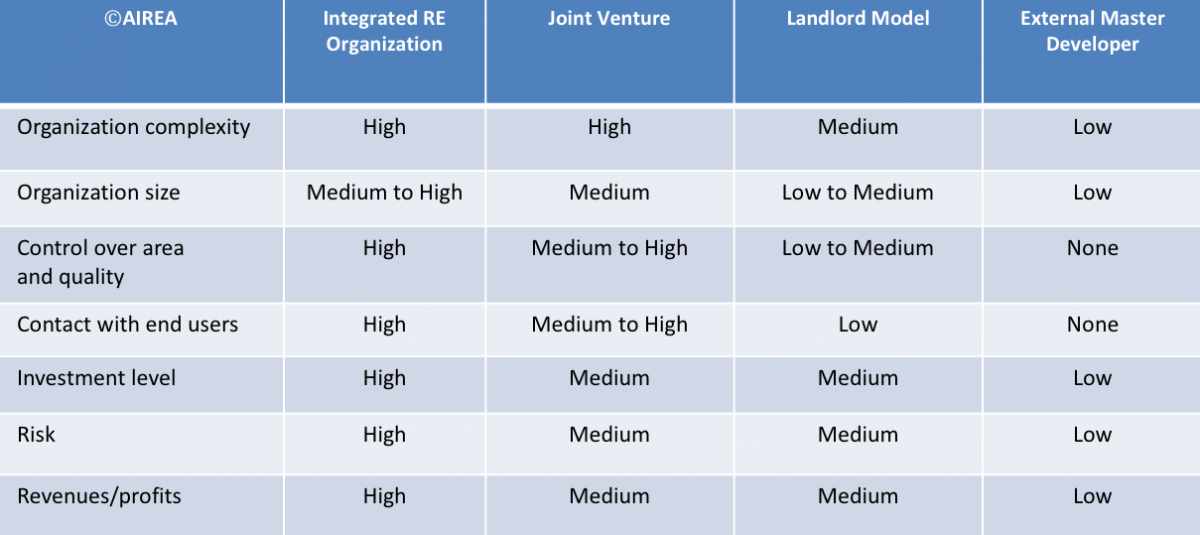

The second step is to decide which model the airport will use to develop the land. Some airport authorities have a dedicated real estate team, or form a subsidiary to manage that portfolio. In other words, they cultivate the expertise in-house, keep track of urban development trends, and maintain close contacts with the local business community to understand their evolving needs. Other airports establish joint ventures with experienced partners. For Singapore’s Project Jewel, Changi partnered with CapitaMalls, the city-state’s leading developer of shopping centers. That model allowed the airport to co-create a new space that increased retail sales, but also pushed some aeronautical functions—meet & greet, for example—into the airport forecourt. Finally, some airports take a hands-off approach, and simply sell or lease the land to third-party investors and developers. The chart below summarizes these different models.