How can airports find new sources of growth?

-

-

This is the first article in a series about how airports can use existing assets to create new sources of growth. Today, we focus on one of airports’ most valuable assets: land.

As we enter Year 2 of the COVID crisis, key patterns are emerging that will determine the future of air travel well into the mid-2020s. These patterns can be summed up in two words: patchworks and partnerships.

(Full disclosure: the first part of this article is a little depressing. The rest is a lot more fun.)

Patchworks

In the next stage of the pandemic, airports and airlines will need to learn how to cope with wildly uneven operating environments. A small handful of countries have successfully tamed COVID—at least for now. They’ve done that through aggressive vaccination, by limiting cross-border travel, or by doing both. These early success stories are celebrating the fruits of their labor: schools, restaurants, and concert halls are reopening, and a semblance of normal life has thankfully returned.

-

But for most of you reading this, I’m guessing that’s not the case. Europe is stuck in an endless cycle of lockdowns and mismanaged vaccination schemes. Vaccine skepticism is hampering immunization in places as diverse as Hong Kong and Oklahoma. And around the world, the rapid spread of virus variants forebodes new challenges ahead.

The upshot for aviation? For the foreseeable future, we’ll be dealing with wildly different health situations that can change at the drop of a hat. A few lucky airports will welcome customers with digital vax certificates, traveling between destinations where COVID is under control. Some will operate in a hybrid environment, where locals have been vaccinated but most visitors have not—or vice versa. Around the world, air traffic will wax and wane to the familiar drumbeat of travel restrictions, lockdowns, and sluggish demand. The resulting patchwork—of regulations, cash positions, and customer sentiment—makes a quick return to pre-COVID numbers unlikely.

Patchworks is the first keyword that will define how aviation evolves over the coming years. The second keyword? Partnerships.

-

Partnerships

As we’ve discussed before, COVID exposed considerable risks in the airport business model. It also taught airports a valuable lesson: if you want to survive, diversify your revenue.

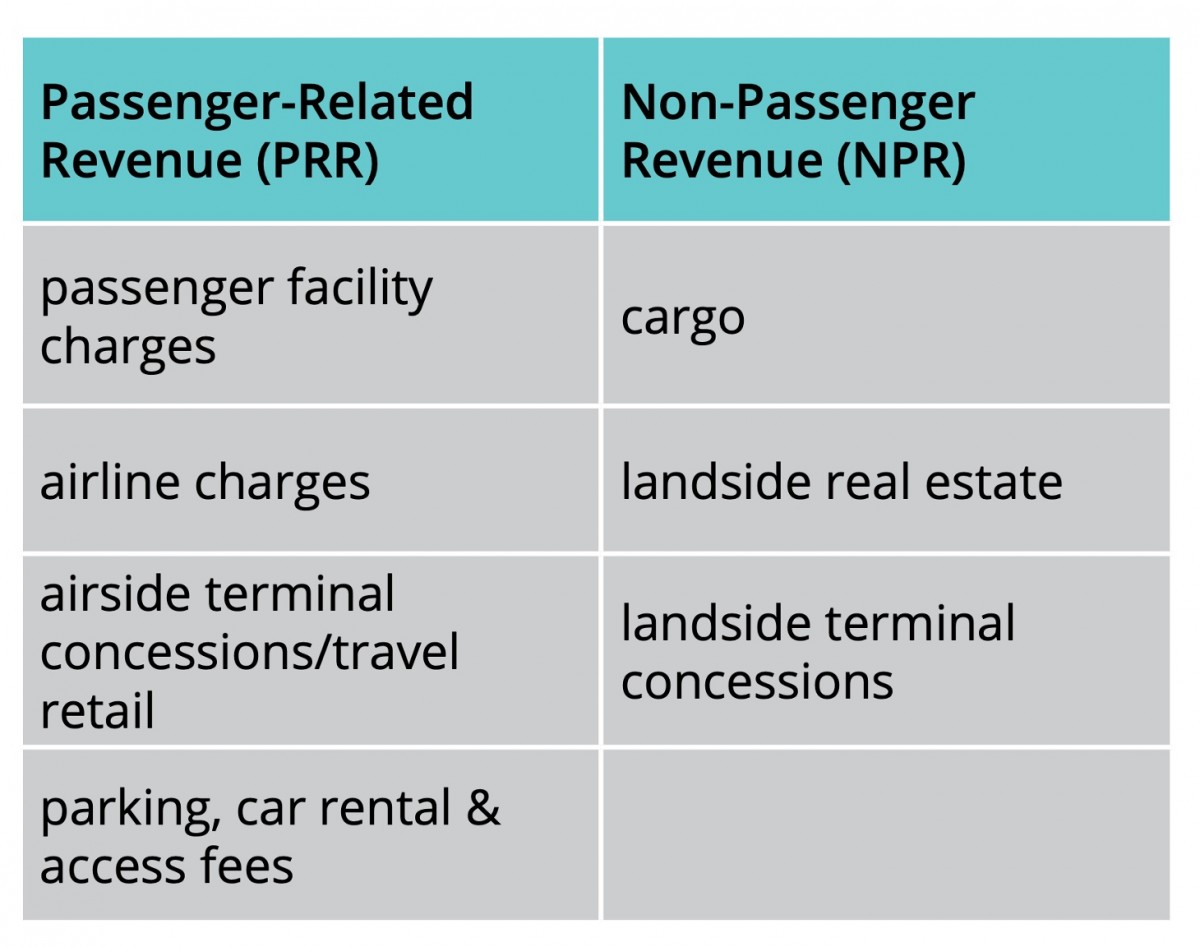

Airports that rely heavily on a single income source—say, passenger and airline fees from a single carrier—are performing much worse compared to airports that have a broad portfolio of income sources. That’s because successful airports strike a balance between passenger-related revenue and non-passenger revenue (more on that here and here).

-

As the name suggests, passenger-related revenue depends on air travelers for growth. When passengers disappear, that income does too. By contrast, non-passenger revenue sources are immune to sudden changes in passenger numbers. When travelers evaporate, they provide a much needed financial cushion.

Don’t get me wrong: passengers will always be our core customers. But non-passenger revenue sources—such as cargo and real estate—will play a much bigger role in the next business cycle. Whether it’s a new office building, a conference hotel, a more efficient parking garage, or a 5G-enabled logistics hub, these landside projects need to be fast-tracked if airports want to diversify their revenue and emerge from COVID more financially resilient than before. That’s true for industry stalwarts like JFK, Heathrow, and Dubai, and it’s true for the greenfield hubs emerging in Europe, Australia, and the Middle East.

Unfortunately, many airports don’t have the financial resources to move these ambitious projects forward. A few lucky ones have the money but lack the know-how. Still others shy away from the risks that such projects entail. Simply put, airports face a tough choice: on the one hand, they need to find new sources of growth. On the other hand, many are not in a position to develop those alternative revenue streams on their own. How can airports address that challenge?

-

Collaborative development

This is where collaborative development comes in. By taking an innovative approach to moving these projects forward, airports can generate new sources of growth from one of their most valuable assets: land. Collaborating with the right partners—be they public or private—is a powerful tool to address funding gaps, mitigate risk, and bring in the know-how needed to develop successful landside projects. Doing so empowers airports to strengthen their business model and prove their long-term financial resilience to shareholders, regulators, and ratings agencies.

To better understand the opportunity for airports, let’s take a look at two key questions. First, who are those potential partners? And second, what are the benefits of joining forces?

When it comes to unlocking the value of an airport’s land assets, public-sector partners come in many shapes and sizes. They include pension funds, whose investment horizon is measured in decades rather than quarters, and whose key objective is to create and preserve long-term value. Public partners also include economic development and regional planning agencies, who can provide incentives to attract an anchor tenant, and can marshal the resources needed to run a masterplanning competition. Finally, university partners can contribute both funding and expertise to kickstart aviation tech hubs and industrial clusters.

What about partners in the private sector? They include a wide range of potential partners, from local developers and entrepreneurs to institutional investors that operate globally. From an airport’s perspective, these private partners are an important source of capital. But they’re also a crucial source of know-how: introducing technological and managerial innovations into the development process, and offering industry-specific insights that can drive future biz dev opportunities. From the airport’s perspective, the long-term benefits of that knowledge transfer far exceed the financial rewards of any single project.

Collaborating with private-sector partners also helps airports to mitigate risk. Venturing into a new line of business can be scary. And capital-intensive projects—especially in areas where the airport has little experience—can involve risks that the airport is unable or unwilling to take on. A collaborative development structure enables the airport to transfer those risks to an external partner, or to contain them within a separate company.

-

The takeaway

There’s no denying it: the airport industry is in trouble. Finding new sources of growth—and leveraging our existing assets in new ways—will be essential if we want to survive the next few years.

Land is one of our industry’s most valuable—and most underutilized—assets. Many airports have sketched out ambitious plans to develop the landside. Yet they often face three common barriers to realizing its commercial value: a lack of money, a lack of know-how, and an aversion to risk.

Collaborative development is a powerful tool to overcome all three of these barriers. That collaboration can take on many forms: from pure investment all the way to design, construction, maintenance, and operation. Successful airports tailor the scope of their partnerships according to their own unique strengths and needs. They offer valuable insights for our entire industry—and what pitfalls we should avoid. More on that next time.

Until then, a question for you: how is your airport creating new sources of growth? And who are you partnering with to do that? Get in touch here.

Special thanks to Stuart Cairns, René Droese, Réka Sebestyén, Ginger Evans, Stuart Hair, Moe Kamleh, and Rawley Vaughan.

-

-

-

-

-

-